Staking vs. Lending: What’s the Difference?

Understanding the Key Differences in Earning Passive Income Through Crypto While Navigating EU Regulations

)

Sergio Pisani

Content Writer - Pyaza | Blockchain & Payments Expert

Introduction

Staking vs. Lending: What’s the Difference?

As interest in cryptocurrency continues to grow, many beginners are exploring ways to earn passive income from their crypto holdings. Two common methods are staking and lending. While both can generate rewards, they operate very differently—especially under EU and EEA regulations.

What Is Staking?

Staking is the process of locking up your cryptocurrency to help maintain and secure a blockchain network that uses a proof-of-stake (PoS) mechanism. In return, you earn rewards—typically in the form of the same cryptocurrency.

You’re essentially pledging your coins to the network, and in doing so, you help validate transactions and keep the network running smoothly.

Examples of Staking

Ethereum (ETH): Staking ETH helps process and validate blocks. In return, stakers receive more ETH as a reward.

Common Stakable Coins: ETH, ADA (Cardano), SOL (Solana), DOT (Polkadot), and others.

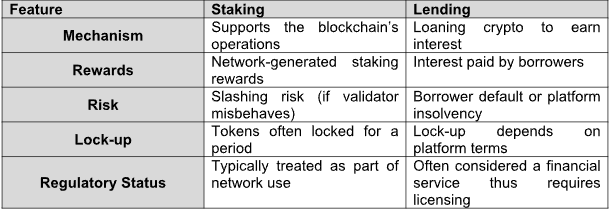

Staking vs. Lending: A Side-by-Side Comparison

While staking involves helping secure a blockchain, lending is more about providing your crypto to someone else in exchange for interest.

Here’s a breakdown:

Regulatory Considerations for Staking

MiCA and Staking in the EU/EEA

Under the Markets in Crypto-Assets Regulation (MiCA), staking is not explicitly classified as a regulated financial service.

Individual users staking on-chain via personal wallets are not subject to MiCA.

Custodial staking providers (e.g., exchanges staking on your behalf) may be regulated under MiCA as Crypto-Asset Service Providers (CASPs).

What About Crypto Lending?

Regulatory Oversight in the EU/EEA

Crypto lending is subject to heightened regulatory scrutiny, as it resembles traditional financial products. Under the EU’s MiCA framework:

Lending services may be classified under “other crypto-asset services.”

Platforms offering crypto loans may require CASP authorization.

They must comply with AML rules, consumer protection, and transparency regulations.

If services fall outside MiCA, they may still be regulated under existing financial laws, particularly if they:

Qualify as financial instruments under MiFID II, or

Involve deposit-taking—potentially requiring a banking license.

How to Stake: Step-by-Step Guides

Staking Through Centralized Exchanges

Create and verify your exchange account.

Deposit or purchase a stakable asset.

Navigate to the staking section and opt-in.

Your assets are automatically staked, and you start earning rewards.

Staking Using MetaMask Wallet

Install the MetaMask browser extension or mobile app.

Transfer your stakable tokens to your MetaMask wallet.

Connect MetaMask to a supported staking platform or protocol.

Follow the instructions to stake your tokens directly from your wallet.

Final Thoughts

Key Takeaways

Staking is a blockchain-native method to earn rewards while supporting decentralization. In the EU/EEA, it’s largely unregulated unless done through a custodial service.

Lending, however, carries greater financial and regulatory risk. Under MiCA, crypto lending is considered a financial service and must meet strict compliance requirements.